open end credit is brainly

Credit cards are the most common form of open-end credit. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time.

When Is A Long Term Purchase On A Credit Card Better Than Taking Out A Loan Brainly Com

Annual Percentage Rate APR.

. False not borrowing a specific amount True or False. What is closed-end credit. Click here to get an answer to your question Describe the difference between openend and closedend credit and provide an example of.

A credit card is an example of closed-end credit. What is closed-end credit. Also called bank line credit line.

Describe how installment credit closed-end credit is different from open-ended revolving credit. Also called bank line credit line. A loan given for a short period of time that is not dependent on credit history.

The borrower is able to withdraw indefinitely until the limit is met. View Homework Help - Unit 8 Text Questions from PERSONAL FINANCE 256 at Franklin High School. Figuring out the cost of an item with sales tax.

Close-end credit is a credit arrangement in which the borrower must repay the amount owned plus interest in a specific number of equal plans usually monthly. Line of credit denotes a limit of credit extended by a bank to a customer who can avail himself or herself of its full extent in dealing with the bank but cannot exceed this limit. Course Title SCIENCE 101.

Credit cards refer to a card issued by a financial institution which allows a cardholder to borrow money against a line of credit. The pre-approved amount will be set out in the agreement between the lender and the borrower. The maximum borrowing power granted to a person from a financial institution.

Open-end loans are also sometimes referred to as revolving credit. Figuring out the price per unit and comparing it to other choices. Charge account credit revolving credit.

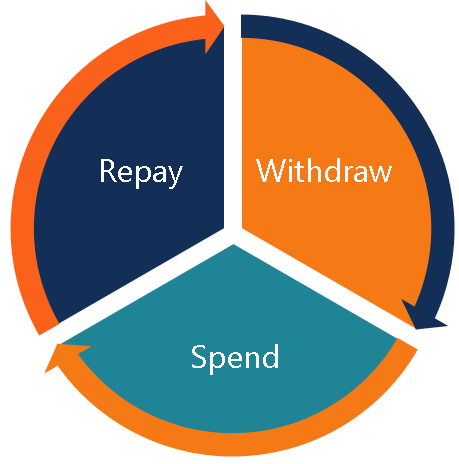

An open-end loan also sometimes referred to as open-end credit is a form of borrowing that can be used up to a certain limit before it must be repaid. Open-ended credit is extended in advance of any transaction so that the borrower. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment.

A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise. Open-end credit - a consumer credit line that can be used up to a certain limit or paid down at any time. An amount of time during which a loan can be repaid without interest.

A type of revolving account that permits an individual to pay on a monthly basis only a portion of the total amount due. Closed-end credit is a one-time loan that you pay back over time in payments of equal. It most frequently covers a series of transactions in which case.

With a closed-end loan you borrow a specific amount of money for a. Charge account credit account open account - credit extended by a business to a customer. An agreement with an institution on a certain amount that can be repeatedly borrowed.

A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit. Consumer credit - a line of credit extended for personal or household use. Pages 2 Ratings 100 1 1 out of 1 people found this document helpful.

Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of open-end credit. B Prohibited acts or practices for dwelling-secured loans. Figuring out the cost of the item to the manufacturer.

To better understand open-end credit it helps to know what closed-end credit means. Up to 10 cash back The Basics of Closed-End Credit. A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise.

Advantages of Open Credit. The effective annual rate of interest on a loan based on a specific calculation as set forth by law. Click here to get an answer to your question what is the difference between closed-end credit and open-end credit AnnieMarie14 AnnieMarie14 04032014 Business High School answered.

A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit. Generally it is uneconomical and expensive for a borrower to borrow money repeatedly every two or three months and repay it fully. This type of Consumer Credit is frequently used in conjunction with bank and department store credit cards.

In connection with credit secured by the consumers dwelling that does not meet the definition in section 2262a20 a creditor shall not structure a home-secured loan as an open-end plan to evade the requirements of section 22632. It enables the cardholder to make basic transaction at the point of sale. In contrast to more traditional loans which are given.

Pledged to a company as security for a loan repayment. A home equity line of credit is an example of open-end credit. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed.

Figuring out what the price will be on an item later that day. Open-end credit is A. Terms in this set 9 Open end credit.

A pre-approved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due.

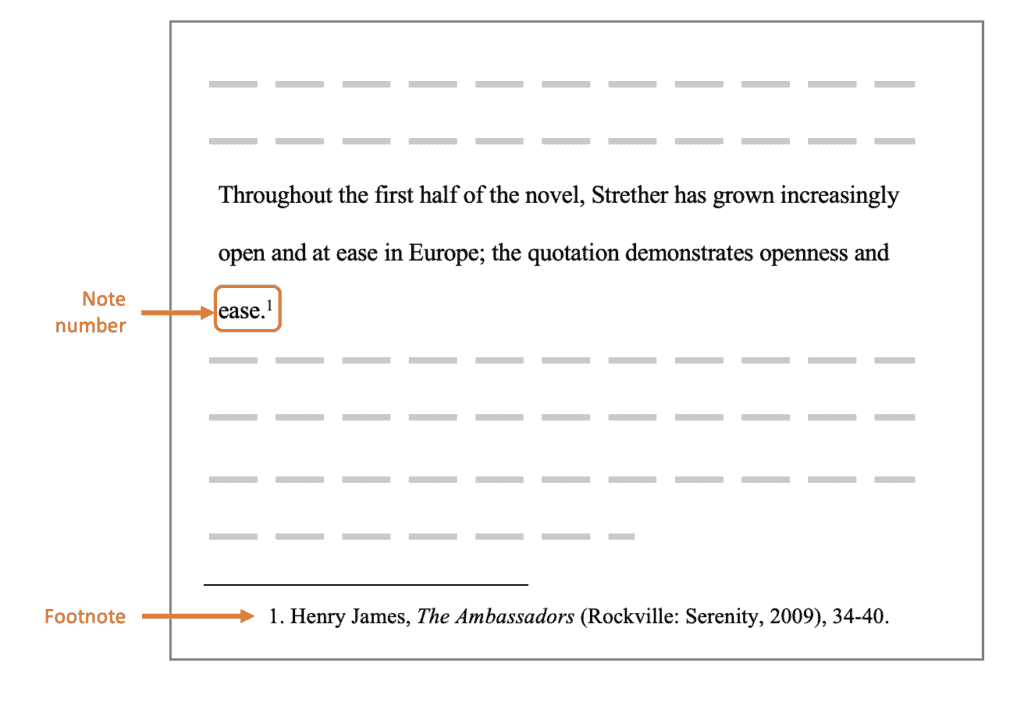

Differences Between Footnotes Endnotes And Parenthetical Citations Easybib

Understanding Different Types Of Credit Check Sort Each Scenario Into The Correct Category Based On Brainly Com

When Is A Long Term Purchase On A Credit Card Better Than Taking Out A Loan Brainly Com

Hurry Today Is My Last Day In Which Two Ways Can Citizens Effectively Improve The Problems In Their Brainly Com

Revolving Credit Vs Line Of Credit What S The Difference

What Is Open End Credit Brainly Com

Plz Help What Is One Type Of Closed End Credit A A Credit Card B A Retail Credit Card C An Brainly Com

Open End Vs Closed End Mutual Funds Overview Features Performance

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference

Fiction Vs Nonfiction Venn Diagram Reading Classroom Reading Lessons School Reading

What Is Open End Credit Brainly Com

Compare Revolving Credit And Closed End Credit Brainly Com

What Happens At The End Of The Story As A Result Of These Three Events Brainly Com

Dylan Opened A Credit Card Account With 725 00 Of Available Credit Now That He Has Made Some Brainly Com

Which Of The Following Is Considered To Be Open End Credit A A Mortgage B A Car Loan C Brainly Com

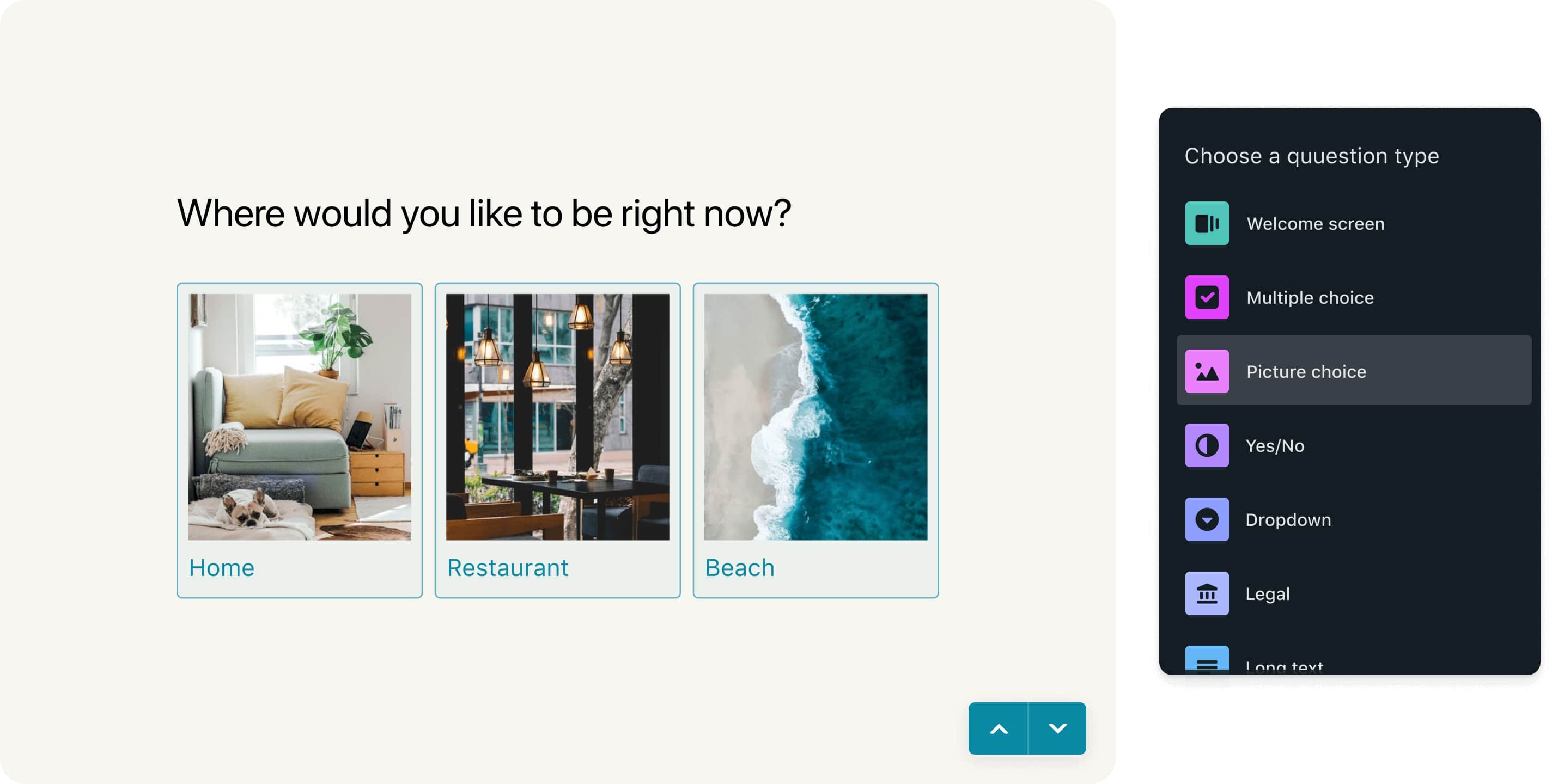

Good Survey Questions Examples Best Practices Tips Typeform

Provide An Example Of A Open End Credit Account That Caroline Has Brainly Com